Documentation & Process

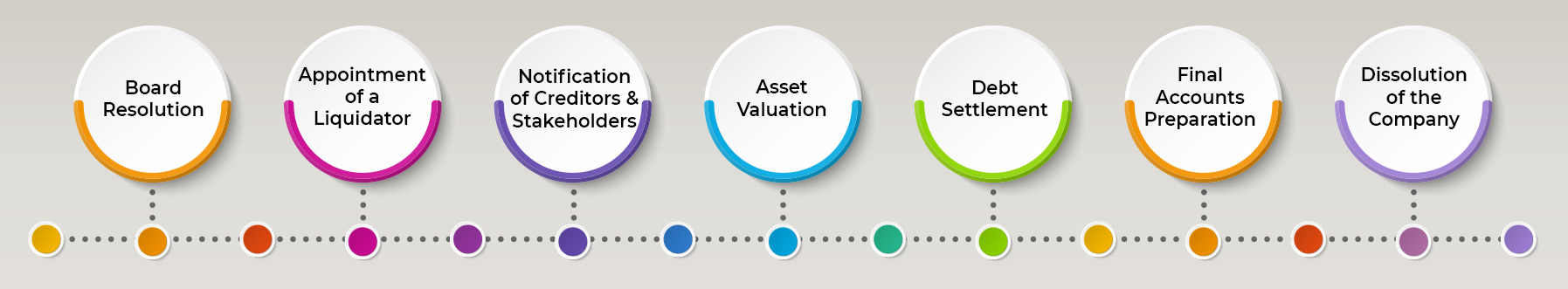

The process of winding up a company involves multiple steps, each requiring careful attention to documentation and legal formalities. Below is a detailed overview of the necessary stages:

1. Board Resolution: The winding-up process typically begins with a formal resolution passed by the board of directors. This document serves as the official record of the decision to wind up the company.

2. Appointment of a Liquidator: A liquidator is appointed to oversee the winding-up process. This individual is responsible for managing the company's assets, settling debts, and ensuring that all legal obligations are met. The liquidator must be a qualified professional with expertise in insolvency and liquidation.

3. Notification of Creditors and Stakeholders: It is crucial to notify all creditors, employees, and relevant regulatory authorities about the decision to wind up the company. This notification serves to inform stakeholders and ensures transparency throughout the process.

4. Asset Valuation: The liquidator conducts a comprehensive assessment of the company's assets, including physical property, inventory, and financial accounts. This valuation is critical for determining the amount available for debt settlement and asset distribution.

5. Debt Settlement: One of the primary responsibilities of the liquidator is to prioritize and settle outstanding debts. Creditors are paid according to the order of priority established by law, which typically favors secured creditors over unsecured ones.

6. Final Accounts Preparation: After all debts have been settled, the liquidator prepares final accounts that document the liquidation process. This includes a detailed report of the financial position of the company at the time of winding up, outlining how assets were handled.

7. Dissolution of the Company: Once all procedures are completed, the company is formally dissolved and removed from the register of companies. This marks the legal end of the company’s existence and concludes its responsibilities.

Every step in the winding-up process is essential to ensure that the closure is managed legally and effectively, reducing the risk of disputes and complications.