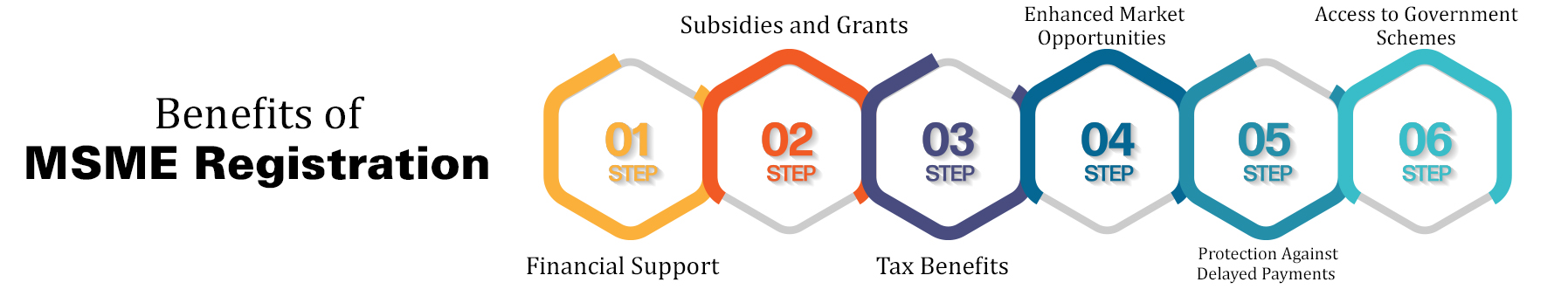

1. Financial Support: Registered MSMEs have access to financial assistance from banks and government schemes, which often offer lower interest rates. This financial backing is crucial for starting new projects, expanding operations, or upgrading technology.

2. Subsidies and Grants: The government provides various subsidies, such as capital investment subsidies, technology acquisition subsidies, and marketing assistance. These grants significantly reduce the cost of doing business.

3. Tax Benefits: Registered MSMEs can benefit from numerous tax exemptions and rebates, including reduced corporate tax rates, income tax concessions, and exemptions from Goods and Services Tax (GST) for specific goods and services.

4. Enhanced Market Opportunities: An MSME registration enhances credibility and visibility, allowing businesses to participate in tenders and contracts issued by both government and private organizations. This can lead to more significant business opportunities and partnerships.

5. Protection Against Delayed Payments: One of the key advantages of MSME registration is the protection against delayed payments. Under the MSME Act, buyers are required to make payments within 45 days of the invoice, providing a safeguard against financial strain caused by late payments.

6. Access to Government Schemes: Registered MSMEs can avail themselves of a range of government schemes designed to support entrepreneurship, innovation, and growth. These include schemes for technology development, skill enhancement, and marketing assistance.